Texas Is Best Described as a Progressive Tax State

Which statement best defines demography 2. What is meant by natural population growth.

Why Some States Are Seeing Higher Revenue Than Expected Amid Job Losses The New York Times

The 2017 tax law limits deductions for state and local taxes to 10000.

. Progressive taxes require those with higher incomes to pay a higher percentage of their income on those particular taxes. The poor in Texas pay a much larger portion of taxes to the state as a percentage of their income than anyone else. The 2005 state sales tax rate in Texas was 625 percent for the state rate.

Most settlers decided to. But existing law also allows up to 2 percent more for. Property and sales tax rates are generally the same for everybody.

Which of the following best describes a progressive tax. All tax schemes can be characterized as either progressive or regressive. It is unlikely that Texans will have an income tax in the foreseeable future because.

They do apply a flat income tax rate to interest and dividend income. Progressive and regressive tax systemsThe Texas Politics Project. Some states -- Alaska Florida Nevada South Dakota Texas Washington and Wyoming -- dont collect any income taxes.

They require those with lower incomes to pay a higher percentage of their income on such taxes. That is very regressive. Most income tax schemes.

The impact of regressive taxes is exactly the opposite. A state constitutional amendment requires that the electorate approve an income tax by referendum. In the past decade the meaning of all men are created equal has been expanded to include women and all.

History Name one main success and one main failure of the Republic of Texas government. However state income tax structures within the United States have just as much variation in terms of progressivity as OECD nations income tax structures. Yesterday we presented data showing that the United States tax code is among the most progressive in the OECD when we compare Federal-level taxes and an average value for state taxes.

The United States to over a large part of eastern Texas C. In a progressive tax system the wealthy pay a larger portion of their income in taxes. Which of the following best explains why local taxes in Texas are higher than in most other states.

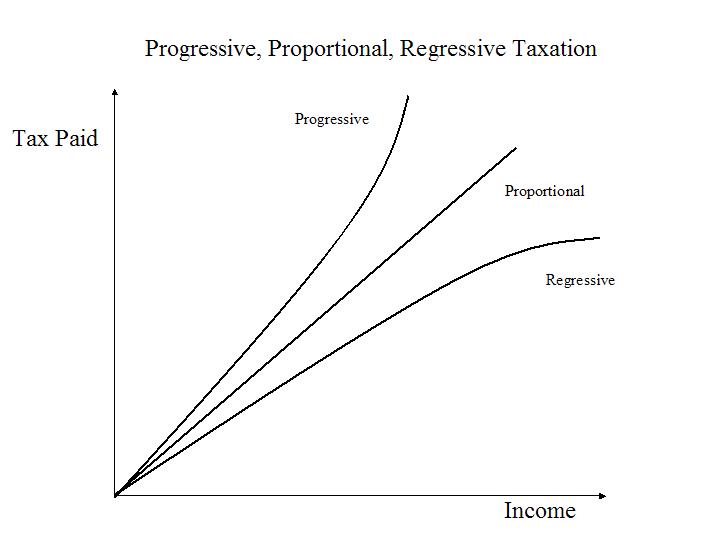

That essentially means they use the opposite of a progressive tax system. Three types of tax systems are used in the USregressive proportional and progressiveand two impact high and low-income earners differently. Then tell how these factors contributed to Texas annexation by the United States what are some.

Texas Succession Quick Check 1. It was based on a progressive tax that took a larger percentage of higher. New Hampshire and Tennessee dont have income taxes on earned income.

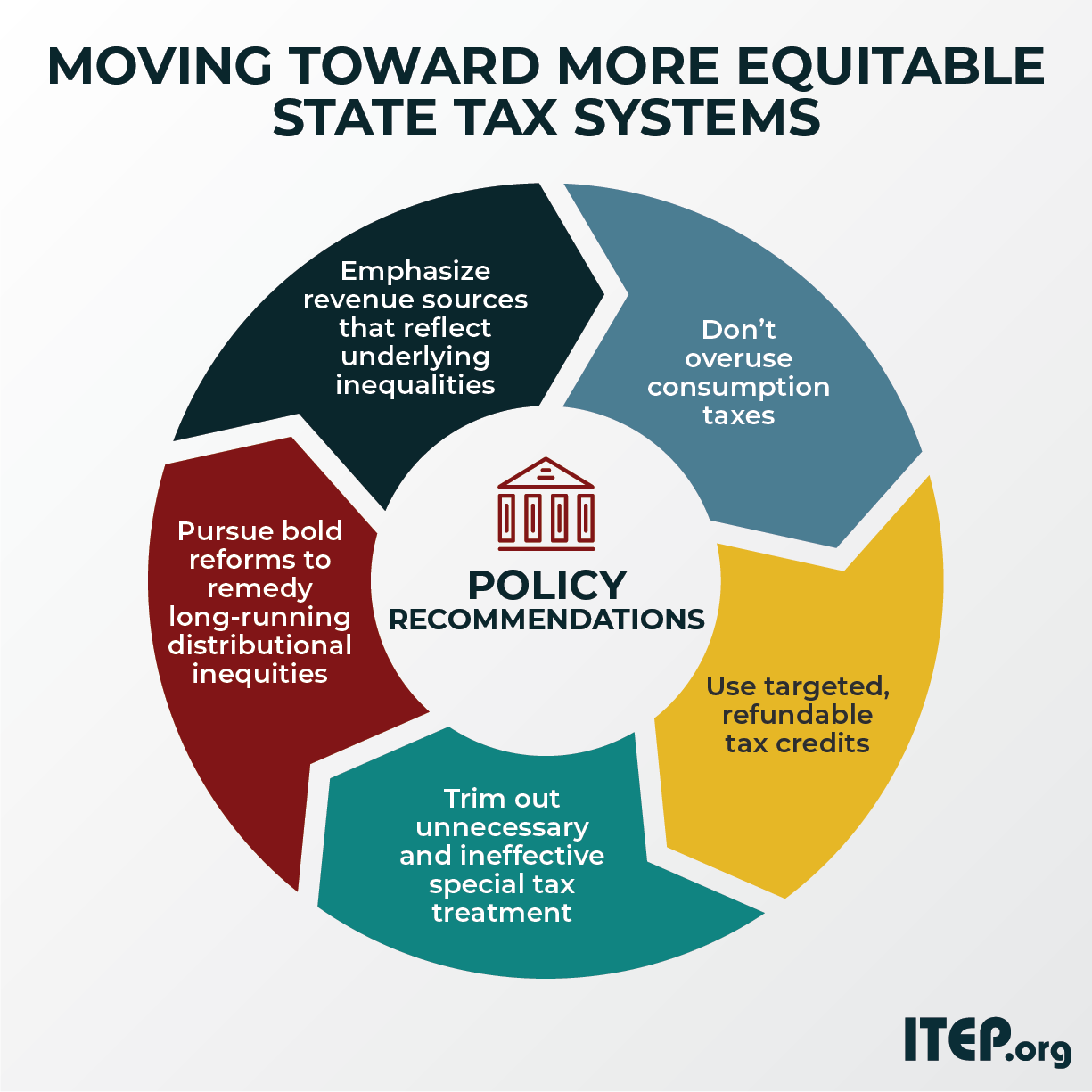

Moving Toward More Equitable State Tax Systems Itep

Are State Taxes Becoming More Regressive Rev 10 29 97

Progressive Tax States Lose People Income To Flat And Zero Income Tax States Wirepoints Wirepoints

Are State Taxes Becoming More Regressive Rev 10 29 97

Progressive Tax States Lose People Income To Flat And Zero Income Tax States Wirepoints Wirepoints

How Do Taxes Affect Income Inequality Tax Policy Center

What S The Difference Between Progressive And Regressive Taxes Youtube

Progressive Or Punishing Is Illinois Proposed Progressive Tax As Fair As Other States Center For Illinois Politics

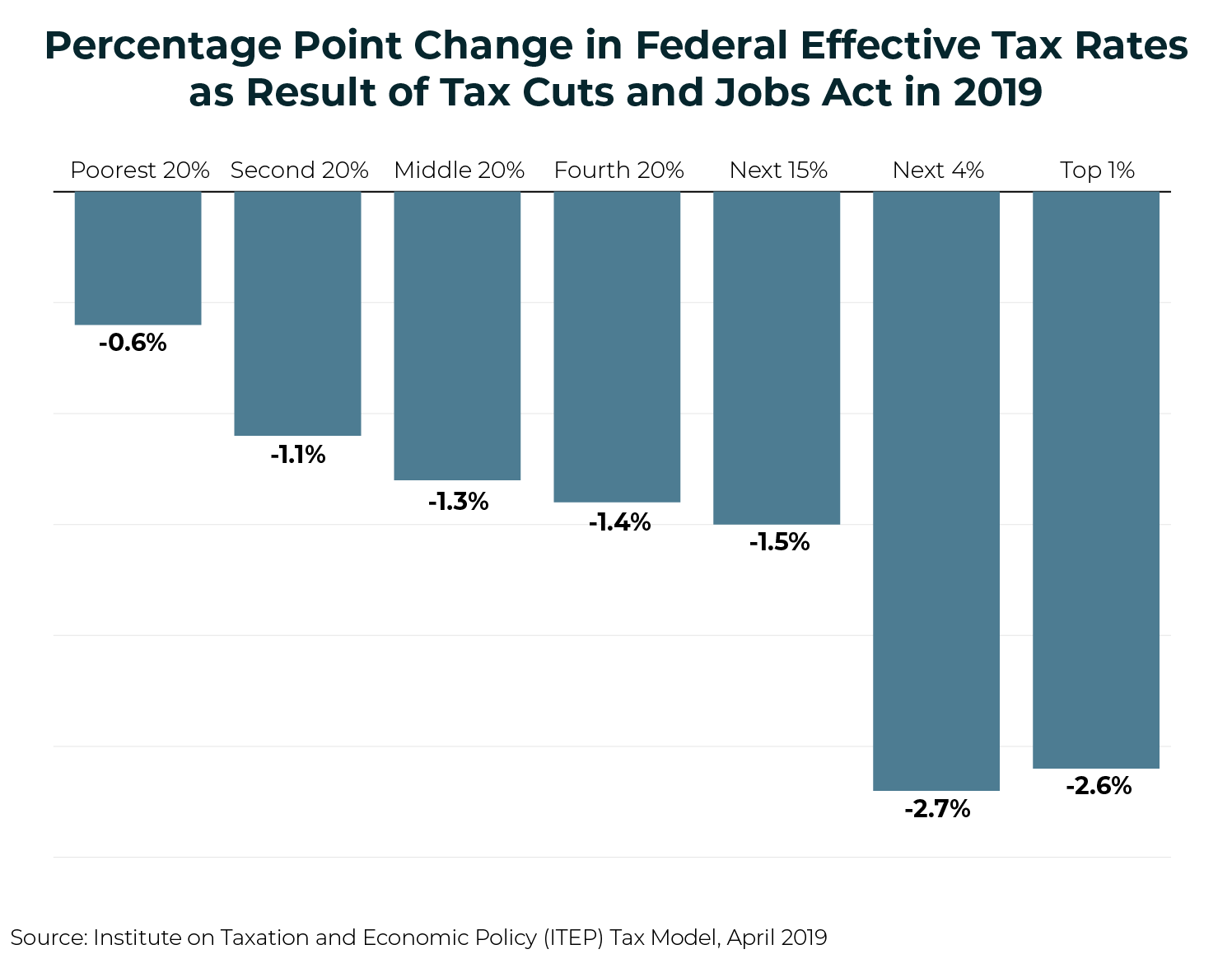

Who Pays Taxes In America In 2019 Itep

Putting A Progressive Income Tax In Perspective The Devil S In The Details Center For Illinois Politics

Progressive Tax States Lose People Income To Flat And Zero Income Tax States Wirepoints Wirepoints

Progressive Tax States Lose People Income To Flat And Zero Income Tax States Wirepoints Wirepoints

Tax The Rich Progressive Activist Womens T Shirt In 2022 T Shirts For Women Graphic Tee Shirts Shirts

Are State Taxes Becoming More Regressive Rev 10 29 97

Full Coverage Commercial Auto Insurance

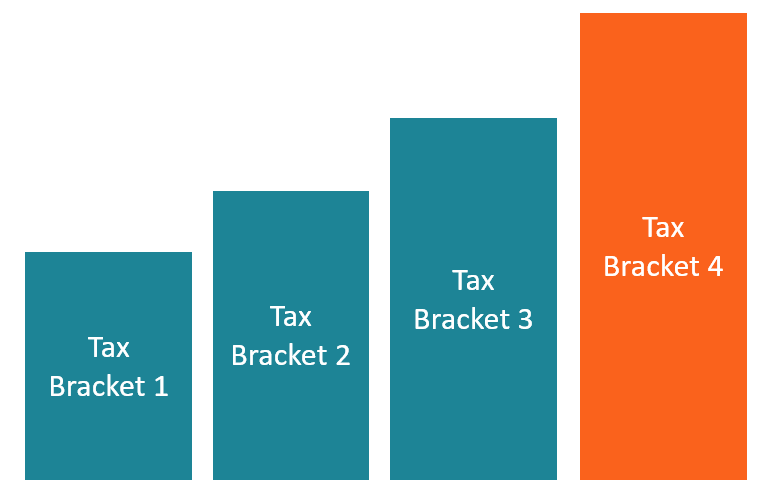

Progressive Tax Know How A Progressive Tax System Works

Resourcesforhistoryteachers Progressive Proportional And Regressive Taxation

Comments

Post a Comment